experienced the impact of covid 19 due to the declining ratio from 2019 (before covid 19) to 2020 (during the covid 19 pandemic). From the profitability side 2 ratios that have been tested and prcocessed, namely ROA and ROE, it can be concluded that from the profitability side of PT Semen Indonesia Persero Tbk. did not experience the impact of covid 19 due to the decreasing ratio from 2019 (before covid 19) to 2020. From the 6 ratios that have been tested and also processed, it can be concluded that in terms of efficiency PT Semen Indonesia Persero Tbk. Before and also during the Covid 19 pandemic, namely 2019-2020, it was presented in 6 financial ratios, namely the ratio of total assets turnover, fixed asset turnover ratio, inventory turnover ratio, accounts receivable turnover ratio, inventory age, and age of accounts receivable. Efficiency Ratio of PT Semen Indonesia Persero Tbk. From the leverage side 2 ratios that have been tested and processed, namely DAR and DER, it can be concluded that from the leverage side, PT Semen Indonesia Persero Tbk. did not experience the impact of covid 19 due to the increasing ratio from 2019 (before covid 19) to 2020 (during the covid 19 pandemic). From the liquidity side of the 3 ratios that have been tested and processed, namely NWCA Ratio, Current Ratio and Quick Ratio, it can be concluded that from the liquidity side of PT Semen Indonesia Persero Tbk. Descriptive analysis here uses a thought based on a theory of financial ratio analysis on the company's financial statements in order to obtain a financial ratio that will be used to provide an overview of the company's financial performance in a predetermined period. Where the Financial Statement data is obtained from the Indonesia Stock Exchange (BEI). by using the required data through the company's financial statements where the company's financial statements that are needed are the income statement and also the statement of financial position (balance sheet). The subject of this research was conducted at PT. companies using the basic theory of financial ratios. in 2019 - 2020 (Before and during the COVID-19 pandemic). In this study the object to be seen is financial performance with a predetermined period so that the data needed is the financial report of PT Semen Indonesia Persero Tbk. The approach and also the type of research used by the researcher is descriptive research.

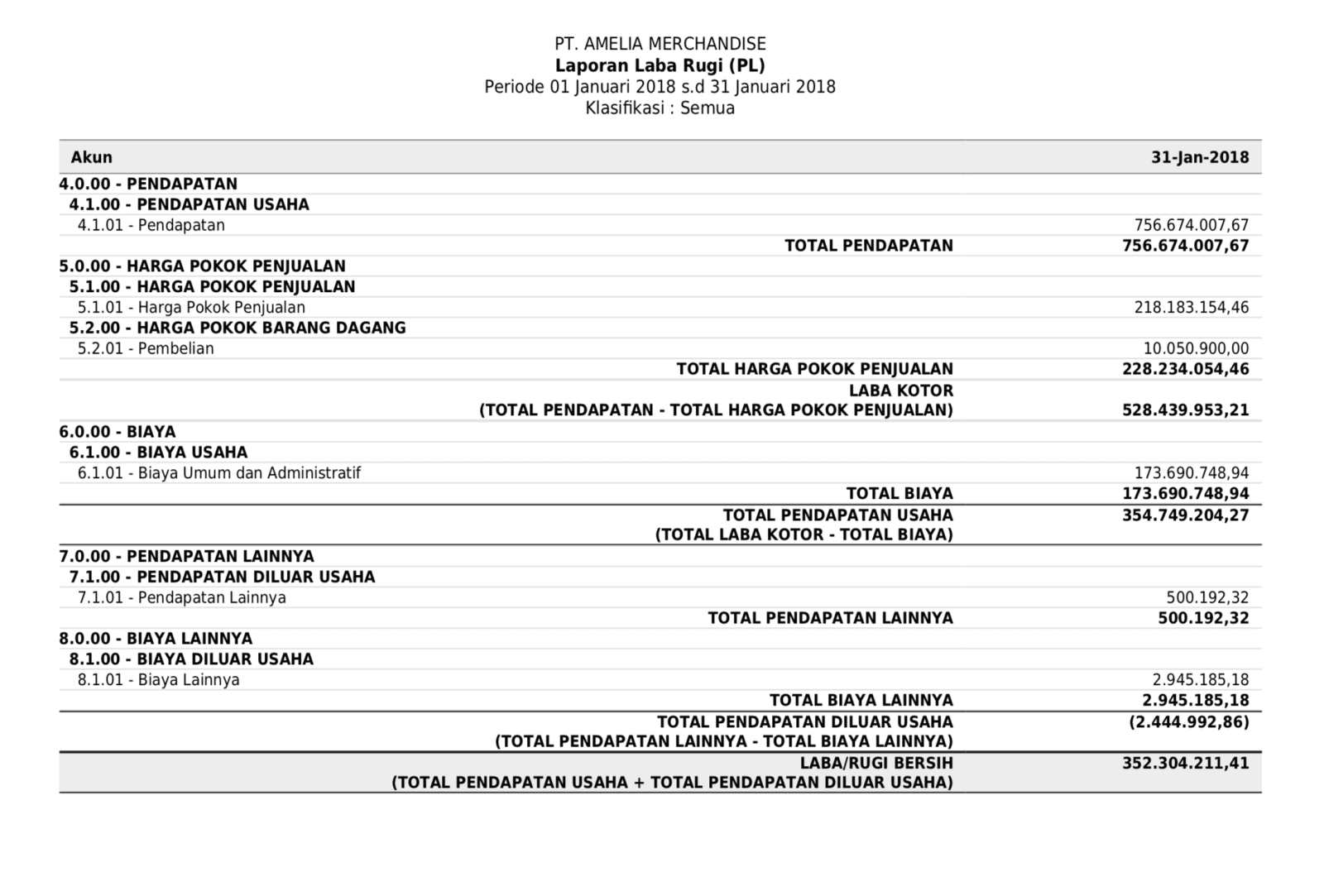

This makes each company carry out strategies to be able to win the existing competition, in order to continue its business or be able to maintain its survival. In the current Covid 19 pandemic, competition in the business world is also getting tougher. (Case Study PT.Fakultas Ekonomi dan Bisnis, Universitas Widyagama MalangĬovid 19, Financial Ratios, Financial Performance Abstract Item Type:ĪNALYSIS OF COMPANY'S FINANCIAL REPORT AS Based on the calcululation of the above ratio, it can be concluded that the prospective debtor company classified as a less good company because the company's performance declines year by year, so it is not worthy to give the credit. Activuty ratio calculated with receivable turnover, inventory turnover, and total assets turnover. PSAK digunakan oleh perusahaan (entitas) yang memiliki akuntabilitas publik, baik yang sudah terdaftar di pasar modal, maupun yang masih dalam proses pendaftaran pasar modal. Solvency ratio calculated with debt-assets ratio anda debt-equity ratio. Standar ini adalah patokan penyusunan, pencatatan, penyajian, dan perlakuan laporan keuangan, agar informasi keuangan yang dihasilkan, relevan bagi pengguna laporan. Profitability ratio calculated with gross profit margin, profit margin, net profit margin, ROA and ROE. Financial ratios calculated consist of: liquidity ratio, calculated with current ratio and quick ratio.

Bank Maspion Indonesia, Tbk 2015, 2016, and 30 September 2017. This ratio analysis is based on the financial statements of prospective debtor companies of PT. Analysis of financial statements using the horizontal method of analysis is a comparison of financial statements of several periods, so it can be known about the development. This study focused on the extent to which the analysis of financial stantements of prospective debtor companies became the basic for decision making on working capital loans. Membuat laporan keuangan memang suatu keharusan bagi setiap instansi perusahaan dinas maupun lembaga organisasi lainnya dengan tujuan untuk menganalisa pengelolaan keuangan di instansi tersebutContoh Laporan Keuangan Sederhana Usaha Kecil Ukm Cara Buat Contoh Laporan Keuangan Neraca Dan Laba Rugi Perusahaan Contoh Laporan Keuangan Perusahaan Jasa Transportasi. Analysis of financial statements is an analysis technique performad by bank in analying the financial aspects of prospective debtor companies as the basic of decision making of working capital loans.

0 kommentar(er)

0 kommentar(er)